can i get a mortgage if i owe back taxes canada

If you owe back property taxes the taxing authority gets a lien on your house for the amount due plus any interest and penalties. Ad 2022 Latest Homeowners Relief Program.

Pin On Accounting Tips For Female Entrepreneurs

Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a.

. Ad Compare Top Mortgage Lenders 2022. Can you get an FHA loan if you owe back taxes. Check Your Eligibility Today.

All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage payments or any other property charges in the past 24 months. One option is taking out a second mortgage which can raise some cash to pay other debts. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it.

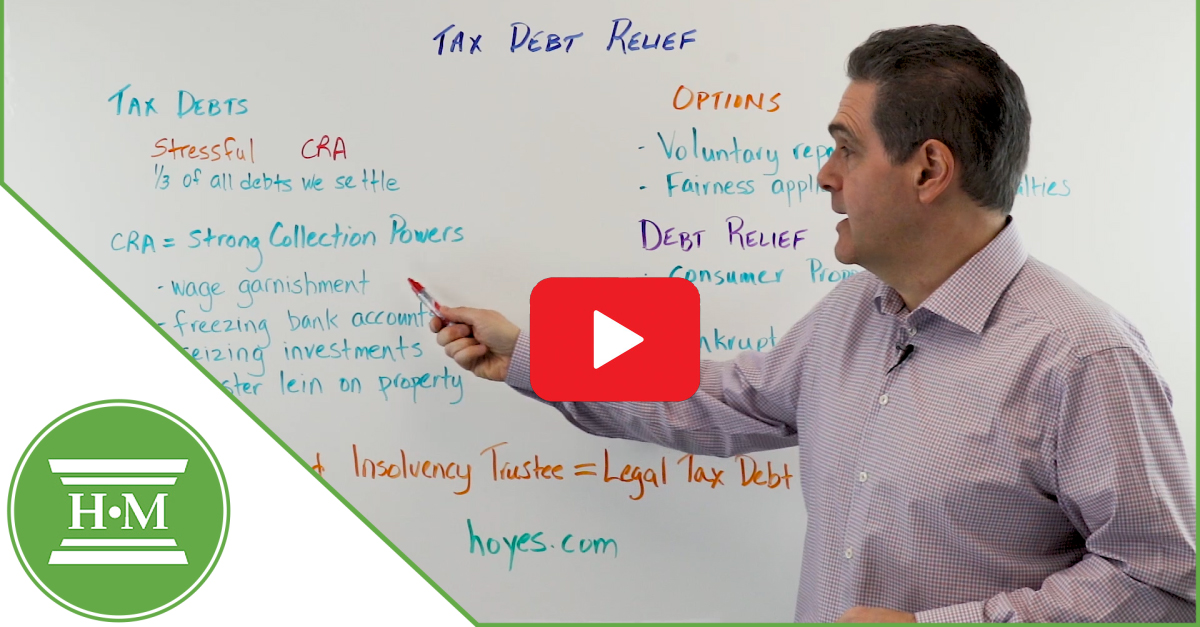

FHA allows borrowers to obtain FHA financing even if they owe Federal income taxes. The canada revenue agency cra can be unforgiving when you owe them back taxes as are the interest rates and fees associated with late payments. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners.

Robert Floris is a Mortgage Broker. 1 If you owe the IRS. A tax debt doesnt equal a blanket rejection for a mortgage.

Also important for a self-employed borrower is. Check If You Qualify For 3708 StimuIus Check. Depending on the type of mortgage you are applying for - FHA.

You do NOT need to pay off the entire tax debt that you owe in order to qualify for a mortgage. If you try to sell your house youll need to. New Federal Program is Giving 3252 Back to Homeowners.

Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Over 937000 Americans have. Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending.

Check Your Eligibility Today. If you put on your tax return a higher mortgage interest deduction than whats on the 1098 that could easily them to get an automated letter. In short yes you can.

The best way to prevent back taxes from becoming an issue is to avoid tax liens. Check Your Eligibility Today. Check Your Eligibility Today.

His office is located at 651 Fennell Avenue East in. Check Your Eligibility Today. If you owe a little bit in taxes because of some mishaps but intend to pay them promptly late penalties and all youll have less of a problem acquiring a mortgage than.

Mortgagees are prohibited from processing an application for an FHA-insured Mortgage for Borrowers with delinquent federal non-tax debt including deficiency Judgments. So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely. The borrowers need to.

Europe Middle East. So in this case a person can take. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan.

Im happy to tell you that it is possible and this is how you do it. Respond to notices from the IRS and if the taxes are seriously late try to work out a. Taxes withheld from you can arise from your employer or.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Can i get a mortgage if i owe back taxes canada. Many people dont think its possible to get a mortgage if you owe the IRS back taxes.

Prior to filing their tax return some Canadians choose to make a financial deposit with the Canada Revenue Agency. New Federal Program is Giving 3252 Back to Homeowners.

5 Tax Tips For Canadian Families Callistas Ramblings Small Business Tax Deductions Business Tax Deductions Mortgage Payoff

Self Employed Mortgage Options Qualifications Wowa Ca

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Cause Unfair Taxes Tax Lawyer Tax Payment Plan Retirement Planning

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Pin On Awesome Blogs To Follow

2022 No Tax Return Mortgage Options Easy Approval

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada